The danger of tax revenue increasingly being lost through illicit money flows is becoming more prevalent and this has contributed to weakening African Economies. A Public Dialogue held at Makerere University under theme "ILLICIT FINANCIAL FLOWS AND EXPLORING CONCEPTUAL AND PRACTICAL CHALLENGES" gathered some of the best minds to address the crisis. According to a recent survey, Africa loses 50 billion dollars annually through illegal financial dealings and money outflows. “A lot of the poverty but also the inequality in the country, the failure of services is because of the money that is being lost.

This money is even more than we get overseas as development aid. The aid is less than the money that is lost, so some studies say the illicit flows are three times, some say it is ten times.” Said, Irene Ovonji Odida – CEO, FIDA. “African drug trade, illegal arms dealings as well as bribery and theft by corrupt government officials, all these activities have one thing in common; they are carried out by the rich and the powerful at the expenses of the poor and the weak.” Said, Mogens Pederson – Danish Ambassador.

Multinational co-operations have been named as some of the main culprits since many practice tax invasion, tax avoidance, and profit repatriation. “Ministry of Finance and the government as a whole is in the process of encouraging all these companies to list so that Ugandans can be able to buy shares from these companies so that some of these profits can remain in Uganda.” Said, Baker Tumwebaze – Principal Economist, Ministry of Finance. “We signed at a global level, the global forum membership.

This forum ensures that we are supposed to get information from 117 countries globally. And so, what that means is that with the power of the information, we should be able to look and dig into these sophisticated tax avoidance schemes the aggressive tax planning.” Said, Stella Nyapendi – Official, URA.

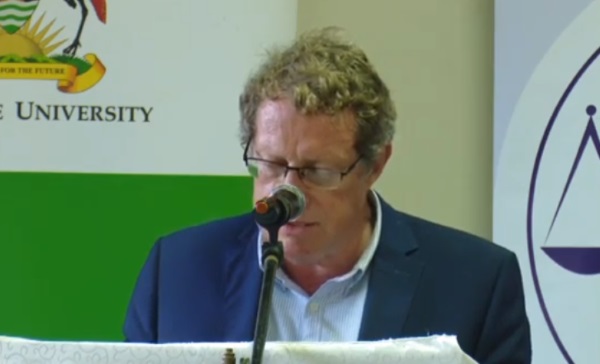

The president of Global Finance Integrity Raymond Baker said in order to curb illicit financial flows, governments need to spend a lot of money tracking the flow of money instead of criminals. “We succeeded in driving terrorist financing out of the legitimate financial system. We can do the same with other forms of criminal money if we focus on the money more than on the crime person.” Said, Raymond Baker – President, Global Financial Integrity. Illicit financial flow has certainly left many African countries including Uganda financially bleeding, whether it is too early or too late to deal with the crisis, it will certainly leave the next taxpaying generation with a price to pay.